inheritance tax rate colorado

After you die someone will become responsible for taking over your estate and determining whether it owes any estate taxes. It happens if the inherited estate exceeds the Federal Estate Tax exemption of 1206 million.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

There may be capital gains taxes on the inherited property if you sell.

. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. The state and average local sales tax rate is 539. Considering the progressive rate that can reach up to 40 the Federal Estate Tax may.

Diesel fuel is taxed at a rate of 205 cents per gallon. Federal legislative changes reduced the state death. When it comes to federal tax law unless an estate is worth more than 5450000 no estate tax is collected.

Answered in 6 minutes by. While federal law still imposes estate taxes on certain estates only about two of every 1000 people who pass away or 02 percent have to pay any taxes at all. The gas tax in Colorado is 22 cents per gallon of regular gas one of the lowest rates in the US.

Inheritances that fall below these exemption amounts arent subject to the tax. In Pennsylvania for instance if a parent inherits property from a child age. Luckily the basic exemption for federal taxes is high so that most estates wont have to pay an estate tax.

It was lowered from 455 to 45 because of a high fiscal year revenue growth rate. Inheritance tax rates typically begin in the single digits and rise to a max of anywhere between 15 and 19. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

An estate tax is imposed on the property before it is being transferred to heirs. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Colorado estate tax applies whether the property is transferred through a will or according to Colorado intestacy laws.

However Colorado residents still need to understand federal estate tax laws. Understand the different types of trusts and what that means for your investments. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Inheritance tax is a tax paid by a beneficiary after receiving inheritance. The rate goes back to 455 for 2022. Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning.

What is the colorado inheritance tax rate. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. A state inheritance tax was enacted in Colorado in 1927.

Colorado does not have inheritance taxes but there are federal estate taxes. If you receive a large inheritance and decide to give part of it to your children the 15000 limit per year still applies. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

Income Tax Deductions for. However Colorado residents may have to face some fiscal burdens even if they inherit property within the state. Colorado Capital Gains Tax.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Colorado has a flat tax rate of 45 for 2021 meaning everyone pays the same state income tax regardless of their income. There is no estate or inheritance tax collected by the state.

Estate tax is a tax on assets typically valued at the. First estate taxes are only paid by the estate. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit.

Ask Your Own Tax Question. Ad Fisher Investments has 40 years of helping thousands of investors and their families. The District of Columbia moved in the.

Any more than that in a year and you might have to pay a certain percentage of taxes on the gift. Select Popular Legal Forms Packages of Any Category. If it does its up to that person to pay those taxes not the inheritors.

The 29 state sales tax rate only applies to medical marijuana. All Major Categories Covered. Inheritance taxes are different.

For the 2021 tax year Colorado has a flat income tax rate of 45. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance. As of 2018 an individual can give another person up to 15000 per year as a gift tax-free.

If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. There is no estate or inheritance tax in Colorado.

Sales Taxes In The United States Wikiwand

2022 Property Taxes By State Report Propertyshark

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Everything You Need To Know Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center

Don T Die In Nebraska How The County Inheritance Tax Works

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Estate Tax Rates Forms For 2022 State By State Table

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

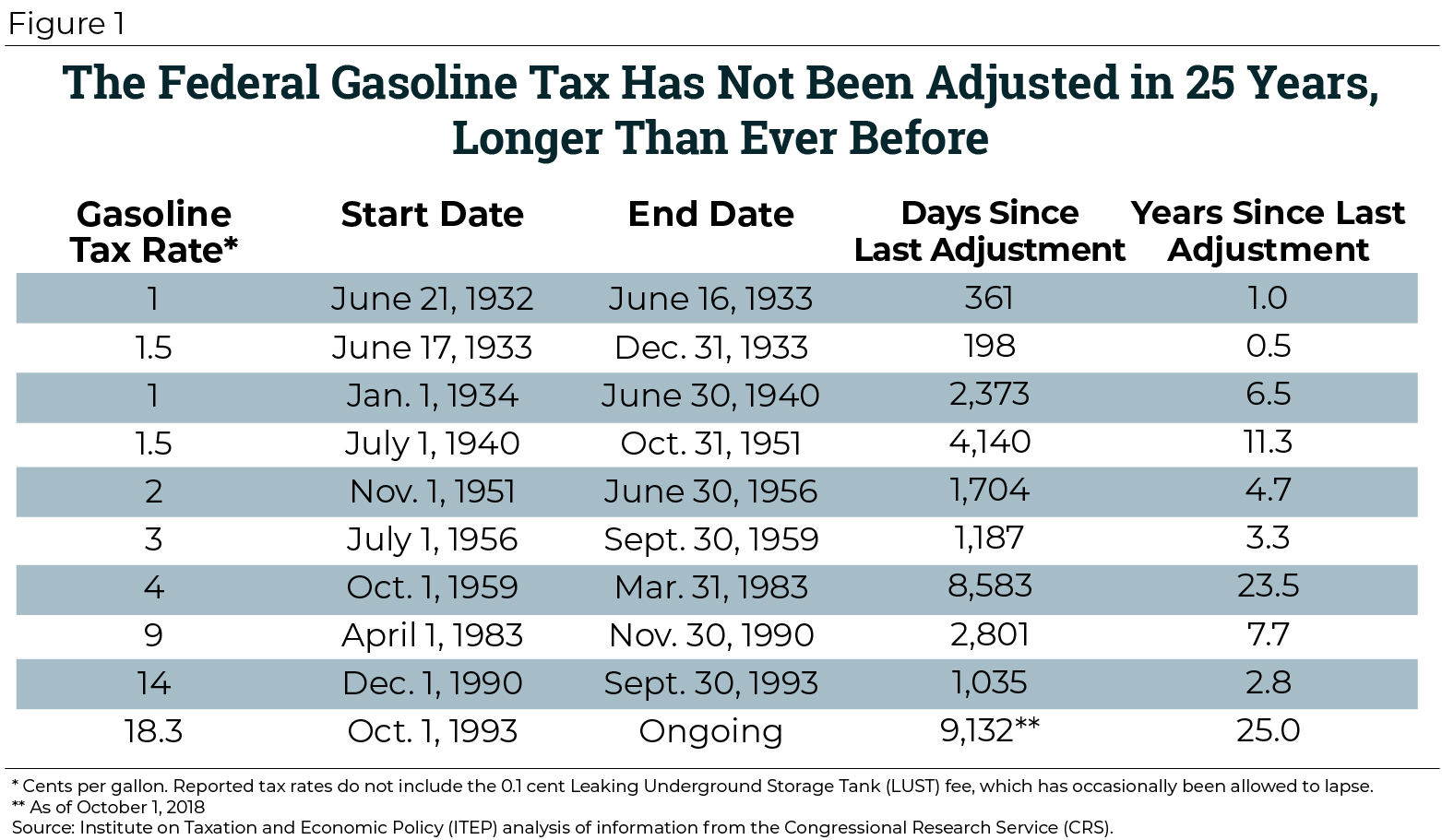

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

The Happiest Cities States Countries All In One Map Infographic Elephant Journal No Wonder My So Happy City Happiest Places To Live States In America

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die